Selling a high-value watch can be different from selling an everyday luxury piece. Once you cross into the $25,000 range, the buyer pool becomes more selective and expectations naturally rise. The upper tier of the resale market simply operates on a different level. At this level, pricing becomes more reference-specific and condition-driven. Two watches that look similar on the surface can perform very differently depending on production year, service history, and market demand.

Many owners begin by trying to understand how much their watch is worth before making any decisions. Market value in the $25,000+ segment depends heavily on completeness, originality, and the current buyer pool. If this is your first time selling at this level or you’re simply weighing your options, knowing what to expect can make the process feel far more straightforward and predictable.

Why High-Value Watches Are Different to Sell

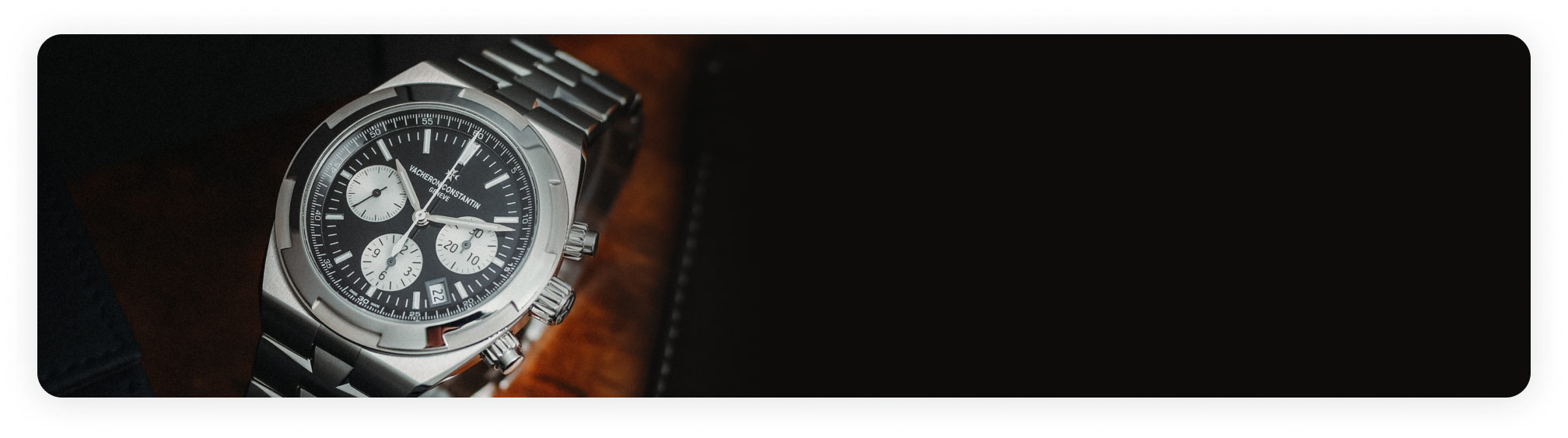

There are not as many high-value watch buyers as there are people shopping in lower price ranges. We often see watches in this price range from luxury brands like Patek Philippe. The buyer pool shrinks because fewer people are shopping for watches priced at $25,000+.

High-value transactions like this also involve more scrutiny and due diligence. Buyers want reassurance about the watch’s authenticity and condition. Just as important, these transactions are often relationship-driven. Trust, reputation, and experience matter more than speed. This slower pace is normal in the high-end watch resale market.

What Determines Value at the $25K+ Level

At this level, there are several things that can contribute to a watch’s value, and it’s not the name on the dial.

The exact reference matters a lot. Even within the same collection, certain sizes, versions, or configurations attract more interest. Buyers will also look at the condition. While regular wear and tear is expected, if a watch shows obvious damage, its value will decrease. Rarity can help, but it is not everything. Some watches are rare simply because they were never widely popular, which means fewer buyers are actively searching for them. In many cases, how easily a watch finds a buyer matters more than how uncommon it is.

Having a complete set helps. Having a complete set helps. It’s not mandatory, but original box, papers, and any documented history increase buyer confidence — especially at the high-value level. Maintaining a clear record of professional watch servicing can further reinforce condition, authenticity, and long-term care when presenting the watch to serious buyers.

The Evaluation Process for High-End Watches

High-value watches typically go through a more detailed evaluation before any serious discussion takes place. You can almost always expect three parts of the process.

Authentication

Authentication usually comes first. Buyers want to feel comfortable that the watch is genuine. You can learn more about authentication during a luxury watch appraisal.

Condition Review

Normal wear is expected, but heavy polishing, replaced parts, or visible damage can influence a sale. Well-loved watches can still be desirable, but clarity around the condition matters.

Market Comparison

Fewer watches trade publicly at this level. Recent transactions, availability, and overall interest can help you understand the current market for a specific watch.

Timing, Offers, and Payment Expectations

Selling high-value luxury watches can take some time. There are less buyers, and the buyers who do shop at this level usually move on the slower side.

Offers can also vary because every buyer will have a different priority. Some may care more about the condition, and others might focus on long-term collectibility. Two offers for the same watch may not look alike. You’ll also come across different kinds of buyers. Private buyers, professional dealers, and consignment arrangements each approach pricing, timing, and risk differently.

Selling vs Trading vs Consigning at This Price Point

At the $25,000+ level, owners usually look at three options to part with a piece. There isn’t a right or wrong. Each one just shapes the experience differently.

Selling Outright

Selling outright gives the most clarity. Owners agree on terms and complete the transaction without waiting for future buyers.

Trading

Trading a high-end watch is more flexible. Instead of focusing only on cash, owners apply the value of their watch toward another piece. Trades shift the focus from timing the market to finding the right replacement watch.

We have a Trade-In Luxury Watch Guide you may be interested in.

Consigning

Consigning takes a longer-term approach. Owners place their watch with a third party and wait for the right buyer to come along. Owners who choose consigning usually feel comfortable waiting.

Common Misconceptions Owners Have

It’s easy to carry a few assumptions into the resale process. Here are some common assumptions that don’t always align with how buyers actually think.

- Retail price equals resale value. Buyers focus on current demand, condition, and availability, not what the watch originally sold for.

- Prestige guarantees a quick resale. Even highly respected brands can have models that take time to place. With brands like Audemars Piguet, some references move quickly while others require patience.

- All buyers value watches the same way. In reality, priorities vary. Some buyers care most about condition, others focus on originality or rarity, and some want a watch they will enjoy wearing.

What This Means for Owners Considering a Sale

Fewer buyers operate at this level, and thoughtful decisions like these take time. Resale difficulty is usually about market fit, not quality. A watch can be beautifully made and still take longer to find the right buyer. Resale difficulty is mostly about how well it matches what buyers are looking for at that moment.

If you’re considering selling a high-end watch, keep your expectations realistic so the process feels more controlled and less stressful. It only takes one buyer to make a sale.

FAQS

Will every buyer value my watch the same way?

No. Buyers look for different things. Some care most about condition, others focus on originality or long-term collectibility, and some simply want a watch they will enjoy wearing.

Does having the original box and papers really matter at this level?

Yes, it often does. A watch can still be desirable without them, but the box, papers, and documented history help buyers feel more confident. It’s not a deal breaker, but good to have.

Should I expect offers to change over time?

Yes, because market interest shifts, availability changes, and buyer priorities evolve. It is very normal for interest and offers to vary.