If you own a Ulysse Nardin, you probably didn’t buy it because everyone else had one. You chose it for the design, the engineering, or the history behind the name. Ulysse Nardin was founded in 1846 in Le Locle, Switzerland. The brand became known for producing highly accurate marine chronometers used by navies worldwide.

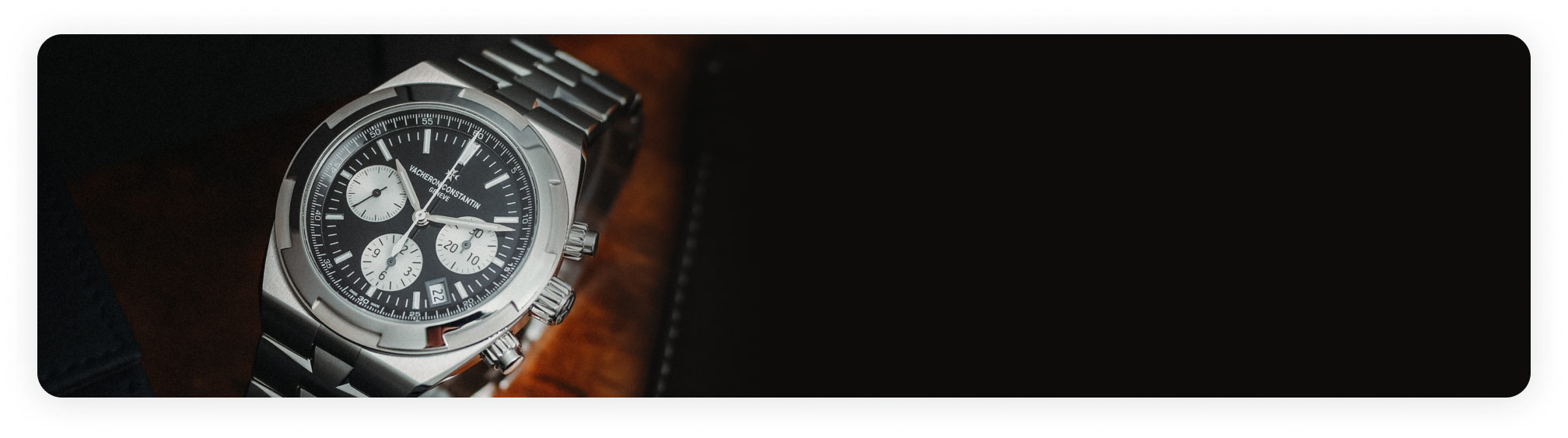

When it comes to resale value, Ulysse Nardin works a little differently than some other luxury brands. Resale performance in this segment often mirrors what we see with brands like Patek Philippe and Vacheron Constantin, where reference number, condition, and completeness significantly influence buyer demand. Demand exists, but it depends heavily on the specific model you own. Let’s look at what really drives resale interest.

Quick Look | Which Ulysse Nardin Watches Hold Their Value Best?

- Ulysse Nardin Freak

- Ulysse Nardin Marine Chronometer

- Ulysse Nardin Diver

- Limited-Edition Pieces

What Impacts the Value Retention of Ulysse Nardin Watches?

Not every Ulysse Nardin watch performs the same way. You’ll have more buyers interested in some models more than others. Here’s what tends to matter most.

The Model and Collection

Some collections consistently attract more attention than others. Iconic models like the Freak and Marine Chronometer are usually in higher demand. There’s a reason why people call this brand the king of marine chronometer watches. Although that doesn’t mean other models don’t have resale value.

Here’s a quick look at some of the most in-demand pieces from the collection over the years. We’ve had a few of these come into our showroom as well.

- Marine Diver Collection – This is the brand’s backbone. The Marine line ties directly to Ulysse Nardin’s heritage. It’s recognizable, balanced, and easy to wear. It usually sees steadier demand compared to more experimental pieces. Diver models have a loyal following.

- Freak Collection – The Freak is in a category of its own. It appeals to serious enthusiasts who care about innovation and movement design. When the right example comes to market, it often draws strong collector interest.

- Blast – The Blast line leans modern and architectural. Skeletonized movements, angular cases, and futuristic styling make this collection stand out. It attracts buyers who want something visually striking.

- Executive – These are older but still relevant on the secondary market. The Executive collection includes bold designs and some high-complication pieces. You’ll still see these trading among collectors, even though the brand has streamlined its lineup.

Craftsmanship and Complications

Ulysse Nardin builds technically impressive watches. Complications like tourbillons, perpetual calendars, and other advanced movements can attract serious collectors. That said, complexity alone doesn’t guarantee higher resale value. Buyers still consider wearability, service costs, and overall demand for that specific model. It’s important to remember everyone has a unique style and taste, too.

Limited Editions and Discontinued Models

Limited production can help support value because collectors already respect the design. When a watch becomes harder to find, interest can increase. But rarity only matters if buyers actually want the piece. A limited-edition model with strong design appeal performs very differently from one with a short production run. It’s always about finding the right buyer.

For example, certain Freak limited editions or older Maxi Marine references that are no longer in production tend to get more attention because supply is naturally limited.

Condition and Completeness

Case wear, bracelet stretch, service history, and whether you still have the original box and papers all influence how buyers view the watch. Two identical references can behave differently solely based on presentation. Well-maintained watches usually attract more offers.

Market Demand and Brand Position

Ulysse Nardin has strong credibility in watchmaking, but it doesn’t have the same mainstream recognition as some of the other most popular watch brands. That affects resale dynamics. Demand exists, especially among informed collectors. But it tends to be more selective and model-driven rather than broad and brand-driven.

When Does It Make Sense to Reevaluate?

Most owners don’t start by deciding to sell. They start by asking questions. Maybe you’re considering rotating into something new or are curious about current demand. At Precision Watches, we provide brand-specific evaluations based on real buyer demand. That way, you understand where your watch stands before making any decisions.

When you’re ready, you can sell your pre-owned watch or trade a luxury watch for something else. Visit our watch showroom in Montgomery County to learn more.

FAQS

Do Ulysse Nardin hold their value?

Some models do better than others. Ulysse Nardin watches tend to hold value most consistently in collections like the Marine and Freak lines, especially when they’re in strong condition and come with box and papers.

Is Ulysse Nardin a high-end watch?

Ulysse Nardin is considered a high-end Swiss watchmaker. The brand is known for marine chronometers, in-house movements, and technical innovation.

Are older Ulysse Nardin models collectible?

Discontinued models and certain limited-edition references tend to attract the most attention. Age alone doesn’t create value, but rarity, condition, and collector relevance can. Other models can perform well, too.

Is Ulysse Nardin considered an enthusiast brand?

Absolutely. It’s a brand collectors appreciate for its engineering and history, especially its marine chronometer roots. It may not be the most mainstream name, but it holds strong credibility with watch enthusiasts.

Do boxes and papers really matter when selling?

Yes, it can make a difference. Having the original box, warranty card, and service records are best. It’s not always a deal breaker, but buyers feel more confident when the watch comes as a complete set.